It does not make any connection between use and payment but simply states that the individuals who are most able to bear the burden of the tax should pay the tax. As the ability-to-pay principle has come to be applied in the United States, it contends that individuals and businesses with larger incomes should pay more taxes - both absolutely and relatively - than those with more modest incomes. Ability-to-pay principle rests on the idea that the tax burden should be geared directly to one's income and wealth. The ability-to-pay principle of taxation stands in sharp contrast to the benefits principle. This video is a brief explanation of the Benefit theory of taxation.Part-2 will be uploaded soon.Link to'Benefit theory of taxation (part-2)' :https://youtu. A progressive tax structure is one in which an individual or family’s tax liability as a fraction of income rises with income. The desirability of encouraging the conclusion of bilateral tax treaties between developed and developing countries was recognized by the Economic and Social. Those who benefit from good roads pay the cost of those roads. I f, as Oliver Wendell Holmes once said, taxes are the price we pay for civilized society, then the progressivity of taxes largely determines how that price varies among individuals. For example, gasoline taxes are typically earmarked for the financing of highway construction and repairs.

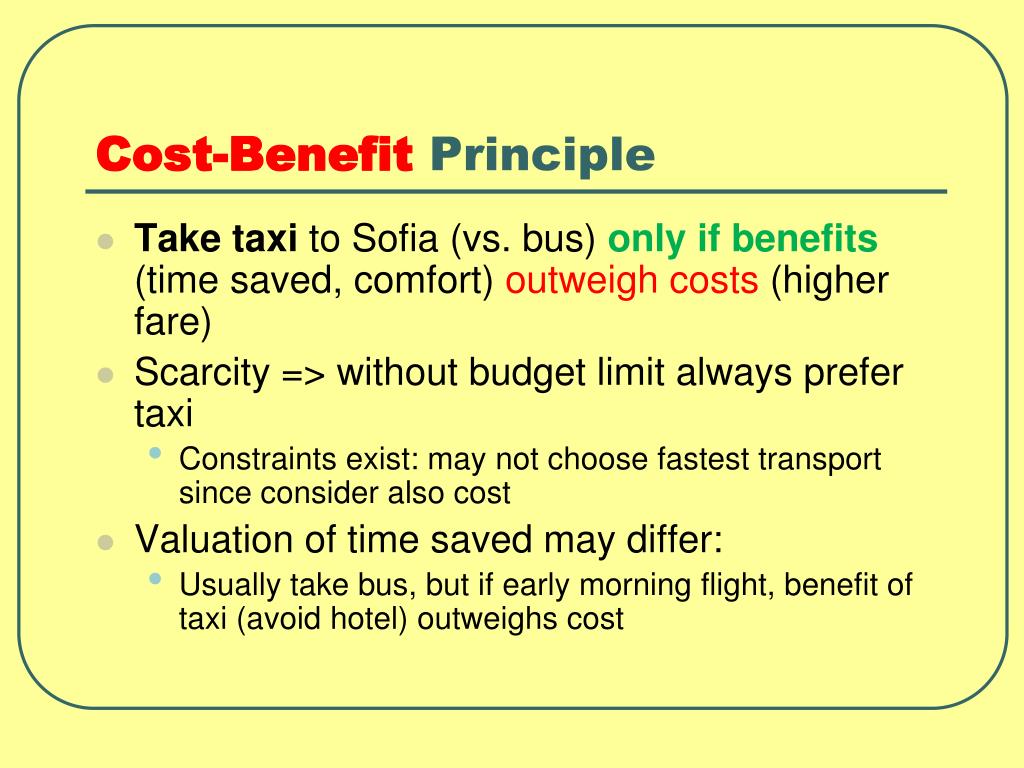

It follows the same principle as the market - the individuals who receive the benefit of a good or service should pay the tax necessary to supply that good or service. The benefit-received principle of taxation asserts that households and businesses should purchase the goods and services of government in basically the same manner in which other commodities are bought.

The are two common philosophies typically given in discussion about aportioning tax benefit received and ability to pay.

0 kommentar(er)

0 kommentar(er)